Why Visibility Isn’t Enough and What Leading Container Shipping Companies Will Be Doing About It

Executive Summary

Container shipping has achieved unprecedented visibility into operations, yet decision latency costs the industry billions annually. This paper examines why dashboards alone cannot close the gap between data and decisions, and how leading carriers are deploying AI-driven optimization to create structural competitive advantage.

1. The Visibility Paradox

Over the past decade, container shipping has undergone an unprecedented wave of digitalization. Vessels are tracked in real time. Port calls are visible to the hour. Containers are scanned, tagged, and monitored across global trade lanes. Executive dashboards display operational metrics that would have been unimaginable a generation ago.

Yet a fundamental paradox persists: why does an industry with more data than ever still struggle to make fast, optimal, and confident decisions?

Freight volatility, port congestion, asset imbalances, and margin pressure continue to challenge even the most digitally advanced carriers. The problem is no longer the absence of data. It is the absence of decision intelligence.

Digital visibility, while necessary, is no longer sufficient. The next competitive frontier lies not in seeing the system but in enabling the system to think, learn, and decide.

2. The Decision Hierarchy

Many shipping organizations implicitly assume that once data is visible, good decisions naturally follow. In practice, the opposite is often true: more data frequently leads to more meetings, more spreadsheets, and more subjective judgment calls under time pressure.

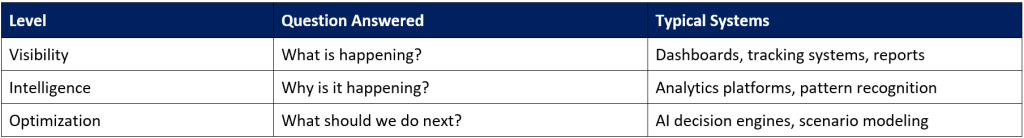

This occurs because visibility, intelligence, and optimization represent fundamentally different capabilities:

Most digital initiatives stop at the first level. The gap between levels two and three is where margin is won or lost.

Consider a disruption on a major East-West trade lane. Dashboards immediately flag delays, rising berth congestion, and vessel bunching. Operations teams react by manually adjusting schedules; operations teams run isolated what-if analyses; senior leaders intervene with experience-based overrides. Decisions are made but not necessarily optimal ones.

The system is simply too complex for human cognition alone. Thousands of interdependent variables vessel capacity, port windows, fuel costs, container availability, customer commitments, and regulatory constraints interact dynamically across time and geography.

3. The Economic Arithmetic of Decision Latency

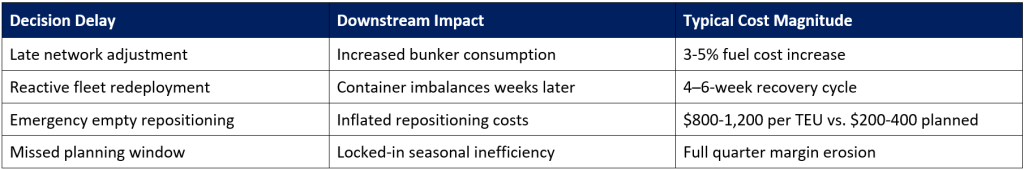

In container shipping, time is not just money it is margin. Delayed or suboptimal decisions compound rapidly across the network:

What often appears as an ‘operational issue’ is, at its core, a decision latency problem. The most successful carriers are not those with the best ships or largest fleets but those that can sense change early, evaluate options rapidly, and execute optimal decisions at scale.

4. The AI Inflection Point

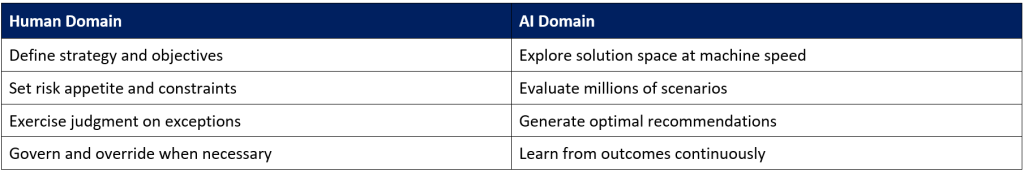

Artificial intelligence in shipping is frequently misunderstood. It is not about replacing people or automating isolated tasks. At its highest value, AI acts as a decision co-pilot continuously evaluating millions of possible scenarios and recommending actions aligned with enterprise objectives.

The optimal division of labor between human expertise and machine intelligence:

This represents a shift from reactive decision-making to anticipatory optimization. Instead of asking ‘What should we do now?’ organizations begin asking ‘What will happen next and how should we prepare for it?’

5. Toward the Self-Optimizing Network

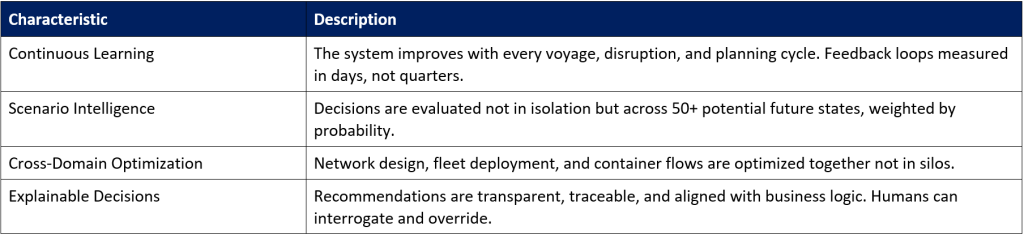

Leading container carriers are moving toward what can be described as a self-optimizing shipping network a system that continuously balances demand, assets, and constraints across time horizons.

Such a network exhibits four defining characteristics:

Achieving this requires more than analytics. It requires an AI architecture designed for maritime-scale complexity one that integrates planning, execution, and learning into a unified decision fabric.

6. Implementation Patterns from Early Adopters

Organizations that have successfully deployed AI-driven decision systems share common patterns:

Start with decision clarity, not data projects. The most successful implementations begin by identifying the five to ten decisions that most impact profitability then work backward to the data and models required.

Build capability in layers. Leading carriers deploy in the following order:

- First – intelligence layers (visibility to insight)

- Second – optimization (insight to recommendation)

- Third – workflow integration (recommendation to action)

Invest in change management. Technical deployment accounts for roughly 40% of implementation effort; organizational adoption accounts for 60%. People must trust the system before they will use it.

Establish clear governance. Define which decisions can be automated, which require human review, and which remain exclusively human. Create escalation paths and exception handling protocols.

7. The Competitive Imperative

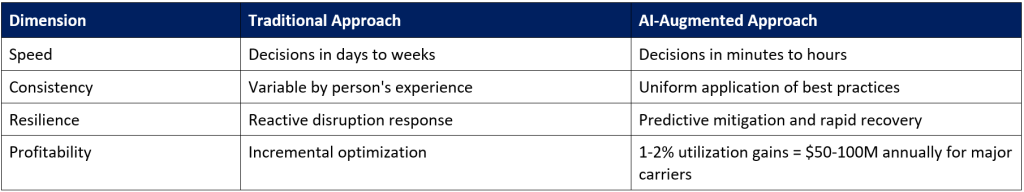

AI-enabled decision-making offers advantages that cannot be easily replicated:

Crucially, these benefits compound. Small percentage improvements in utilization, fuel efficiency, or container balance translate into significant financial impact at global scale advantages that widen over time as AI systems learn and improve.

8. Questions for the Executive Agenda

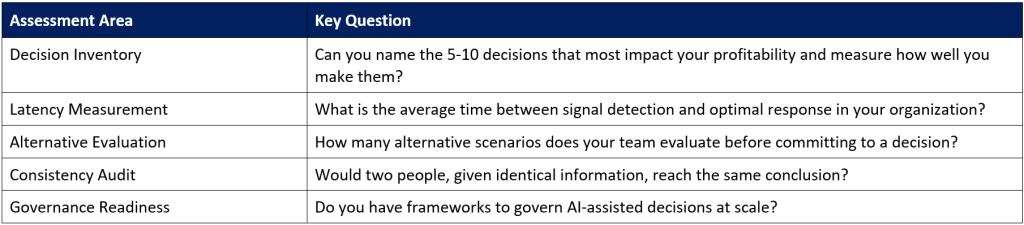

For shipping executives evaluating their organization’s decision capability, we propose five diagnostic questions:

AI-driven decision intelligence represents a structural shift not a technology upgrade. In an industry defined by scale, volatility, and razor-thin margins, the ability to make better decisions faster and more consistently will define the winners of the next decade.

The future of container shipping will not be commanded from dashboards alone but from systems that can think, optimize, and act.

9. Operational Decision Scenario: Cut and Run

Optimizing Schedule Integrity via Decision Enabling Systems in Liner Operations

Situation Overview

In liner shipping operations, a vessel on an Asia-Europe service (calling 12–15 ports) is currently delayed at its final Mediterranean port, Genoa. To maintain its schedule and join the scheduled Eastbound Suez Canal convoy, the vessel must depart immediately. However, 400 containers remain to be loaded, a process requiring 5 to 6 hours. Missing the convoy results in a 12-hour delay at the Suez anchorage.

The Operations Manager faces a “Cut and Run” decision: leave approximately 200 containers behind to save 3 hours and make the convoy, or finish loading and accept the 12-hour Suez delay. A second “Adriatic Far East” service is scheduled to call at the same Genoa terminal two days later, also heading toward the Far East. While this second vessel could potentially recover the left-behind cargo, it would require transshipment at Singapore, adding extra handling costs and potential vessel speeding requirements. The decision requires balancing immediate delay costs against transshipment expenses and vessel efficiency.

Liner services operate on strict “windows” to ensure port productivity and canal transit synchronization. When a vessel falls behind schedule at a key hub like Genoa, the delay cascades through the entire rotation. The primary conflict is between Cargo Integrity (loading all planned units) and Schedule Integrity (maintaining the Suez convoy window).

This scenario explores a “Cut and Run” maneuver, where a vessel departs under-loaded to avoid a 12-hour bottleneck at the Suez Canal. The decision-making process must evaluate the feasibility of “Recovery Services” using secondary vessels to pick up abandoned cargo while accounting for transshipment costs at downstream hubs like Singapore.

10. Decision Flow Process

To create a truly “efficient” scenario, we must add technical constraints beyond just “time.”

Phase 1: The Primary “Cut and Run” Check

Q1: Convoy Synchronization: Will finishing the 400 moves result in missing the Suez window?

Q2: Buffer Capacity: Can the 12-hour delay be recovered by increasing vessel speed (V) later in the voyage? (Analyze fuel consumption/cost increase).

Phase 2: Recovery Service Feasibility

Q3: Capacity Audit: Does the “Adriatic Far East” service have the TEU slots and deadweight (DWT) capacity for the 200 left-behind boxes?

Q4: Terminal Availability: Does the Genoa terminal allow for “Two-Day Dwell” for these containers without excessive storage charges?

Phase 3: Network Impact

Q5: Transshipment Logic: If the recovery vessel does not call at the original destination ports, what is the cost of transshipping those 200 boxes in Singapore?

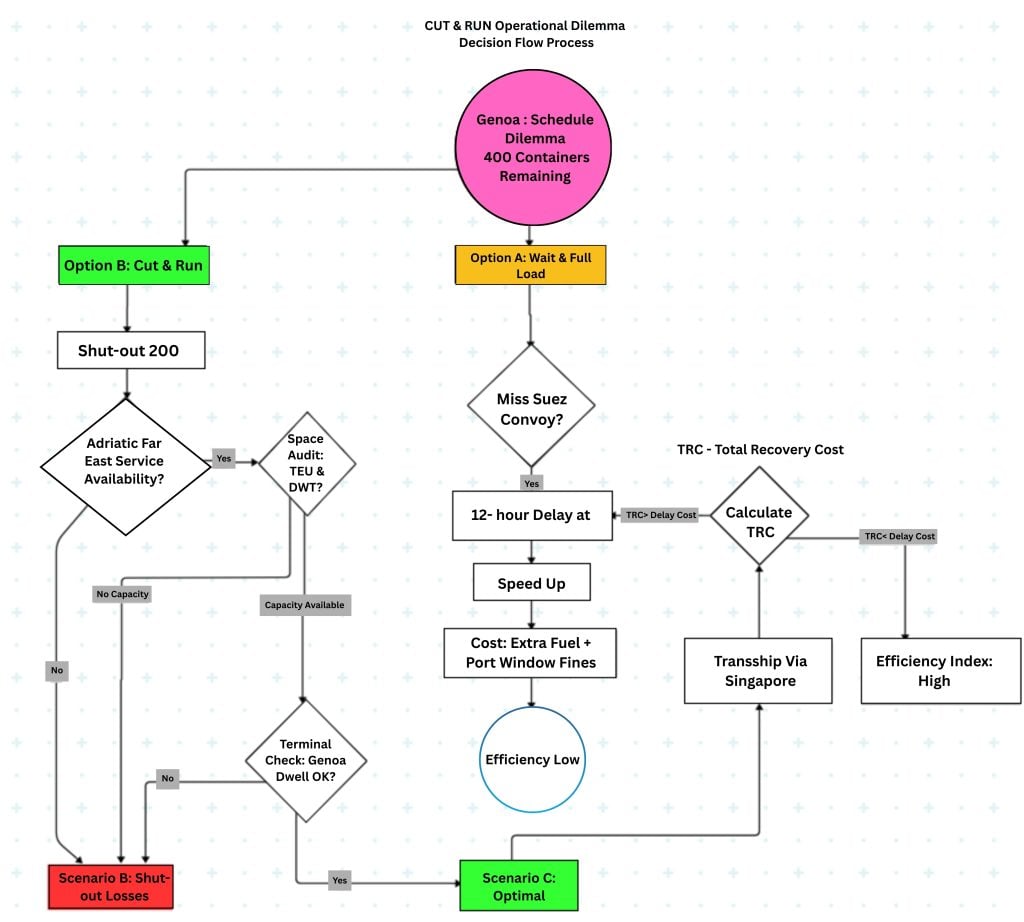

11. Decision Flow Diagram

The following flowchart illustrates the decision-making process for the Cut and Run scenario, showing the critical decision points and their outcomes:

[See accompanying flowchart: Genoa Schedule Dilemma Decision Flow]

The diagram captures key parameters (Fuel Price: $950/TON, FUOT Rice: $2,500/TEU, Spot Rate: $2,500/TEU, Genoa Dwell Fee: $50/CONT/DAY), constraints (Redline Constrained, Crew Hours Exceeded), and the two primary decision paths (Option A: Wait & Full Load vs. Option B: Cut & Run) leading to optimal recovery outcomes.

Comprehensive Regulatory Intelligence Database

- Current IMDG Code: Complete provisions with automated updates for amendments and interpretations (3rd Party DG Compliance platforms)

- SOLAS Compliance: Chapter VII requirements and current enforcement interpretations (Vessel DOC database)

- MARPOL Standards: Annex III restrictions and environmental protection guidelines (3rd Party DG Compliance platforms)

- Global Port Database: Port-specific dangerous goods regulations and seasonal restrictions for terminals worldwide (Company specific data)

- Vessel Documentation: Document of compliance validation and crew certification requirements (Vessel DOC)

- Company Policies: Customizable risk management parameters and approval workflows (Company specific DG carriage policies)

12. The Decision Model: Formulas & Cost Analysis

The current formula focuses only on the Recovery Vessel’s expenses. A “Decision Enabling System” must compare the cost of Option A (Waiting) vs. Option B (Shut out & recover). To make the Total Recovery Cost formula meaningful, we need to account for the “lost opportunity” and “downstream impact” costs that a simple logistics equation often misses.

12.1 Refined Total Recovery Cost (TRC) Formula

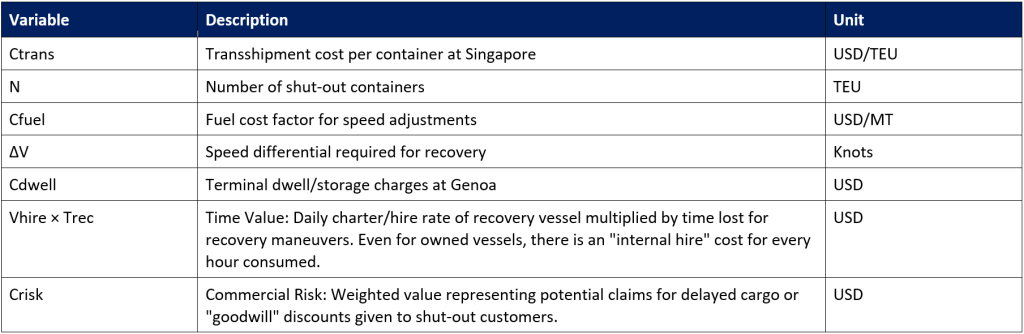

We expand the formula to include vessel hire rates (time value) and the financial impact on cargo owners:

| TRC = (Ctrans × N) + (Cfuel × ΔV) + Cdwell + (Vhire × Trec) + Crisk |

Variable Definitions:

12.2 The Decision Threshold Equation

A formula is only meaningful if it has a counter-weight. The system calculates the Delay Impact Cost (DIC) of the original vessel waiting for the Suez convoy:

| DIC = (Vhire × 12h) + (Cfuel × ΔVcatchup) + Σ PortFines |

Where:

- Vhire × 12h = Cost of 12-hour Suez anchorage delay at vessel daily hire rate

- Cfuel × ΔVcatchup = Additional fuel cost to speed up and recover schedule

- Σ PortFines = Sum of late-arrival penalties at the next 10–12 ports in the rotation

| Decision Logic: The system triggers a “Cut and Run” only when TRC < DIC |

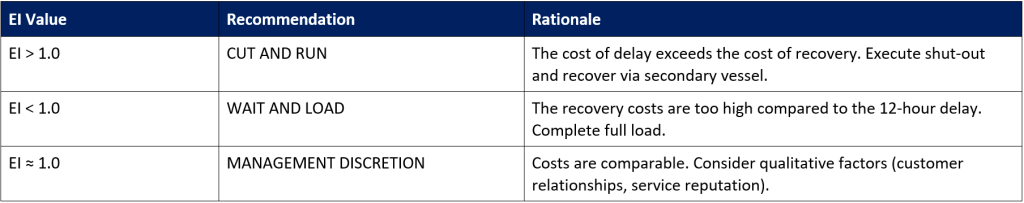

12.3 Efficiency Index (EI)

To provide management a single “Score,” the Efficiency Index is defined as:

| EI = DIC / TRC |

Interpretation:

12.4 Decision System Data Requirements

To make this interactive for operations teams, the system prompts for these specific data points:

Category 1: The Primary Vessel (Genoa)

- Suez Buffer: “What is the exact cut-off time for the Eastbound Convoy?”

- Downstream Sensitivity: “How many ‘Fixed Window’ ports are in the remaining rotation?” (High-impact ports increase DIC).

Category 2: The Recovery Vessel (Adriatic Service)

- Space Availability: “What is the remaining TEU and DWT (Weight) capacity?” (If < 200, recovery is impossible).

- Schedule Slack: “Can this vessel maintain its own schedule if it takes the extra 3 hours to load the shut-out cargo?”

Category 3: Infrastructure & Costs

- Transshipment Efficiency: “Is Singapore terminal currently congested?” (Increases Crisk and Cdwell).

- Fuel Price: “Current VLSFO/MGO price?” (Determines if speeding up is economically viable).

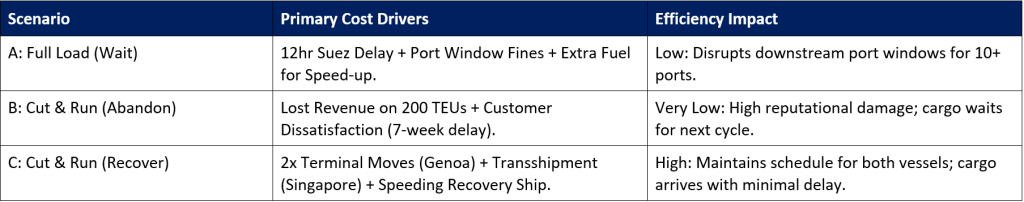

13. Scenario Cost Comparison

The Decision Enabling System evaluates scenarios based on the following cost elements:

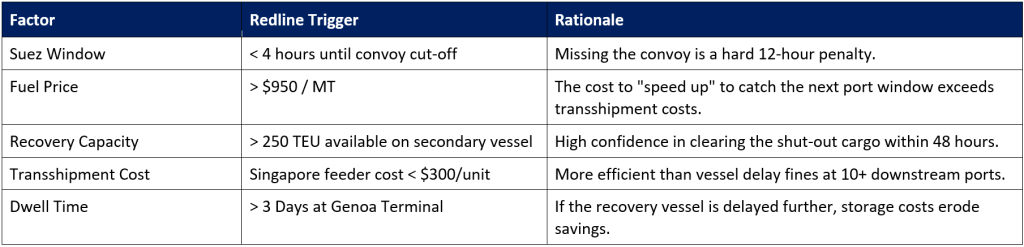

14. Redline Triggers & Thresholds

The system flags automatic recommendations when these thresholds are crossed:

15. Final Recommendation

The system should trigger a “Cut and Run with Recovery” (Scenario C) only if TRC is less than the Delay Impact Cost (DIC) the cost of 12 hours of vessel hire plus late fines at subsequent ports.

This decision framework transforms what is typically a high-pressure, intuition-driven choice into a systematic, data-driven optimization that considers all downstream impacts across the network.

Key Takeaway: When EI > 1.0, execute Cut and Run. The Efficiency Index provides a single, actionable metric for real-time operational decisions.

16. About Solverminds AI Technologies

Since 2003, Solverminds has partnered with liner shipping companies, agencies, NVOCCs, and feeder operators to transform how the industry plans, executes, and optimizes operations. Our integrated platform spans executive intelligence (SEDGIQ), network and fleet optimization (OptiFleet), container flow optimization (OptiBox), and operational execution (ASTRA).

Headquartered in Chennai with over 800 team members, we serve clients across Asia, the Middle East, Europe, and the Americas. Our premise is simple: decisions, not data, create value.

Contact: enquiry@solverminds.com

Web: www.solverminds.com

The information or views expressed in this article is authentic to the best of our knowledge, and as such, it is prone to errors and the absence of some key information, for more information please review our Terms of Use

Solverminds is a global leader in AI-driven maritime software solutions, trusted by top shipping lines, NVOCCs, and feeder operators worldwide. Our mission is to help maritime businesses optimize operations, ensure compliance, and boost profitability through intelligent digital transformation

We offer ERP solutions, optimizers, ASTRA for intelligent process automation, and consultations for your company’s unique needs.

Contact us with a strong focus on digital transformation and sustainable shipping, we help maritime businesses meet IMO compliance, reduce costs, and optimize every aspect of their supply chain.