How Regional Carriers Are Cutting Empty Container Costs by 20%

Monday morning. Your Asia operations desk flags a critical shortage of 40-foot high cubes customer bookings are at risk. Meanwhile, your Europe team reports 180 empties sitting idle in depot.

The solution seems obvious: reposition the empties. But coordinating the move, booking vessel space, and paying handling fees will cost around $120,000 and take three weeks.

By Thursday, the customer who triggered the shortage cancels their booking. The equipment crisis no longer exists. But the repositioning invoice does. This scenario repeats 40–60 times a year across every regional carrier.

Executive Summary

For mid-scale container carriers, empty container repositioning is quietly one of the largest controllable cost categories often comparable to bunker fuel or port charges. Unlike fuel or terminal fees, however, empty container costs receive far less executive attention and far less systematic optimization.

The result? Most regional carriers waste 15–25% of their empty repositioning budget on preventable moves, storage overruns, late-reactive decisions, and local optimization that creates network-wide inefficiency.

The opportunity is significant: carriers who implement AI-driven empty container optimization are achieving 15–25 % cost reduction within 6–12 months freeing up margin that can fund fleet expansion, improve service reliability, or defend competitive positioning.

This article examines why empty container management has become a strategic margin issue for regional carriers, why manual planning breaks down under today’s complexity, and how mid-scale carriers are using AI-driven optimization without enterprise-scale budgets or timelines.

1. The Mid-Scale Reality: Why This Problem Hurts You More

Empty container inefficiency affects all carriers. But it hurts mid-scale operators disproportionately and understanding why the first step is toward fixing it.

Thinner Margins

Mega-carriers can absorb 5 % waste across a $500 M empty-repositioning budget without strategic concern. For a regional carrier, the same percentage of waste across a much smaller budget is the difference between a profitable quarter and a loss.

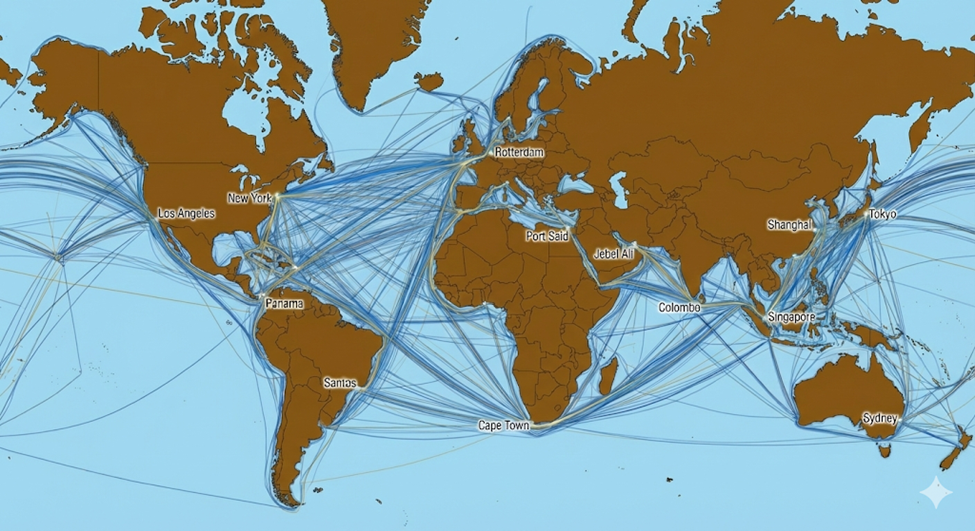

Limited Network Balancing

Global carriers naturally balance empty containers across 200+ ports. Regional operators must actively optimize across 20–50 ports, with far fewer natural balancing opportunities and less flexibility to absorb imbalances passively.

Smaller Teams, Same Complexity

Your planning team manages the same categories of variables demand, capacity, cost, time, equipment type but typically with a fraction of the analytical support available to top-tier carriers. Every manual decision takes longer and carries more risk.

Higher Competitive Pressure

Regional carriers compete primarily on reliability and cost efficiency, not on scale. Equipment shortages destroy reliability. Repositioning waste destroys cost advantage. Both undermine the core differentiator mid-scale carriers depend on.

Key insight: What is a rounding error for a mega-carrier is a strategic problem for a regional operator. The same percentage of waste has a fundamentally different impact on your bottom line.

2. Why Manual Empty Container Management Fails at Scale

Most mid-scale carriers still manage empty repositioning through weekly or monthly planning cycles, Excel-based forecasting, regional teams making localized decisions, experience-based judgment calls, and reactive responses triggered by shortages. A decade ago, this approach was adequate. Today, it is not.

Demand Volatility Has Outpaced Planning Cycles

Historical patterns are less reliable when freight demand shifts within days, not months. Weekly planning cycles cannot respond quickly enough to prevent costly imbalances from forming.

Regional Optimization Creates Network-Wide Loss

When each region optimizes independently, local wins frequently create downstream problems. A decision that relieves pressure in Southeast Asia may generate a larger cost in Europe two weeks later a trade-off invisible to any single team.

The Complexity Ceiling

Manual planning cannot realistically evaluate the trade-offs involved in empty container decisions at scale. Each repositioning choice interacts with dozens of others across time, geography, and equipment type.

- Reposition now vs. lease short-term vs. accept customer delay penalty

- Single-leg move cost vs. multi-leg positioning value

- Current shortage relief vs. future demand positioning

- Equipment type substitution across trade lanes

These decisions involve thousands of interconnected variables a complexity that human judgment alone cannot consistently solve at the speed modern operations demand.

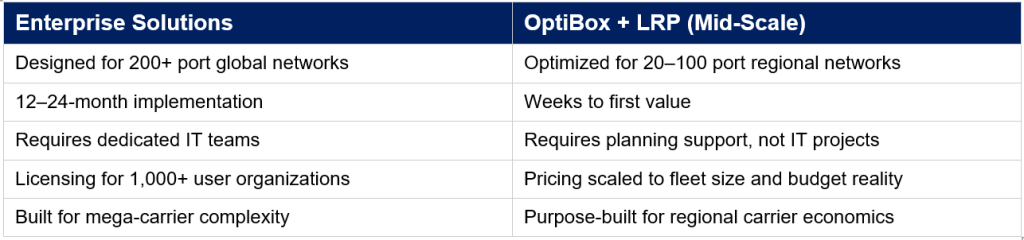

3. Why Enterprise Solutions Don’t Work for Mid-Scale Carriers

If you have previously evaluated empty container optimization, you likely encountered platforms designed for the world’s largest carriers. They are powerful and they are not built for your reality.

The mismatch is structural, not superficial:

- Too expensive – ROI calculations assume very large empty budgets. Licensing models are designed for organizations with thousands of users.

- Too complex – Implementation requires dedicated IT teams, extensive customization, and 12–24 month deployment timelines.

- Too rigid –Built for stable, global networks with deep alliance infrastructure. They adapt poorly to the niche, regional, and opportunistic structures regional carriers rely on.

- Too slow to value – By the time implementation is complete, market conditions have shifted. Mid-scale carriers need weeks to first value, not years.

Mid-scale carriers don’t need a smaller version of a mega-carrier tool. They need purpose-built solutions designed for their operational reality and economic constraints.

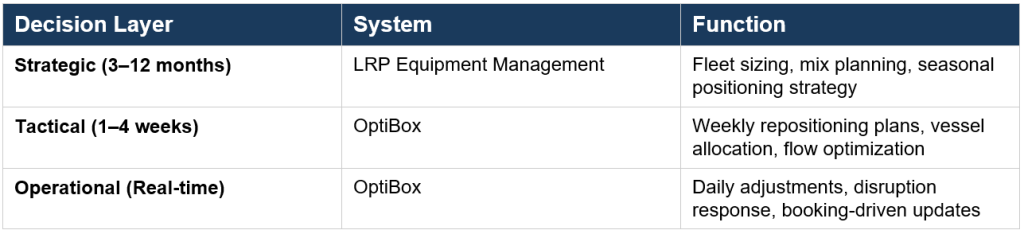

4. The Strategic Foundation: LRP Equipment Management

Before tactical optimization can deliver results, carriers need a strategic planning foundation. Solverminds’ LRP (Liner Resource Planning) platform includes a comprehensive Equipment Management System module that provides exactly this.

Long-Range Demand Forecasting

LRP predicts equipment requirements by location, type, and time horizon incorporating seasonal patterns, trade lane dynamics, and historical trends to move planning from reactive to proactive.

Fleet Sizing and Mix Planning

Determines the optimal fleet size and equipment-type distribution for your network. Balances owned versus leased equipment strategies and models the financial consequences of different fleet compositions.

Strategic Positioning Plans

Establishes target equipment distribution across your network, plans seasonal repositioning in advance of demand shifts, and aligns equipment strategy with service commitments.

Lease vs. Buy Analysis

Evaluates when leasing short-term is cheaper than repositioning owned containers and vice versa. Models cost implications across multiple demand scenarios to support capital planning.

Equipment Lifecycle Management

Tracks container condition, age, and maintenance requirements. Plans fleet renewal and ensures equipment quality meets customer and regulatory standards.

Why this matters: LRP’s Equipment Management module creates the planning baseline that OptiBox optimizes against. Without strategic equipment planning, optimization solves the wrong problem. With it, every tactical decision is grounded in long-term network economics.

5. OptiBox: AI-Driven Empty Container Optimization

Once LRP establishes the strategic plan, OptiBox takes over the tactical and operational layer continuously optimizing empty container flows across your network in real time.

OptiBox was designed specifically for the mid-scale carrier reality: real optimization power without enterprise complexity or cost.

Predictive Demand Intelligence

Uses machine learning to forecast equipment requirements by location, type, and time. Analyses booking patterns, seasonal trends, and trade lane dynamics to identify emerging imbalances before they become expensive shortages.

Network-Wide Flow Optimization

Optimizes repositioning across your entire network not just one region. Evaluates thousands of possible repositioning scenarios simultaneously and balances current costs against future positioning value.

Multi-Constraint Planning

- Incorporates vessel capacity limits

- Accounts for depot availability and handling constraints

- Respects customer commitments and service-level requirements

- Considers full cost structures: transport, handling, storage, and leasing

Trade-Off Evaluation at Machine Speed

For every repositioning decision, OptiBox evaluates the full range of options: reposition via owned vessel vs. third-party carrier, move empty vs. lease locally vs. accept customer penalty, single move vs. multi-leg efficiency, and immediate relief vs. future demand positioning.

Dynamic Re-Optimization

Continuously updates recommendations as conditions change responding to booking updates, vessel delays, port disruptions, and real-time demand shifts without waiting for the next planning cycle.

Explainable Recommendations

Every recommendation comes with clear rationale, cost implications, and trade-off visibility. Leaders can review, override, and govern decisions with full transparency, no black-box outputs.

6. How OptiBox and LRP Work Together

The integration between LRP Equipment Management and OptiBox creates a complete empty container intelligence system strategy feeding optimization, optimization informing strategy, and the loop tightening with every cycle.

This integration ensures:

- Strategic plans are executable at the operational level

- Tactical decisions stay aligned with long-term positioning objectives

- Real-time optimisation operates within strategic constraints

Feedback loops continuously improve forecasting accuracy

7. Real-World Impact: What Regional Carriers Achieve

Carriers using OptiBox integrated with LRP Equipment Management report measurable, sustained outcomes across cost, service, and operational efficiency.

Cost Reduction

- 15–25% reduction in empty repositioning costs

- Fewer emergency repositioning moves at premium rates

- Reduced storage and handling fees through better flow management

- Lower leasing costs through improved utilization of owned equipment

Service Improvement

- Reduced equipment shortages at demand locations

- Faster response to customer booking requests

- Higher equipment availability rates across the network

- Ability to commit to customer equipment guarantees with confidence

Operational Efficiency

- Planning time drops from days to hours for weekly repositioning plans

- Fewer manual coordination handoffs between regions

- Consistent, auditable decision-making across the network

- Clear visibility into cost drivers and continuous improvement opportunities

Strategic Confidence

- Data-driven equipment investment decisions

- Clear understanding of fleet sizing requirements for current and future demand

- Scenario modelling for network changes, new trade lanes, or alliance shifts

- Transparent decision logic that leadership, operations, and finance can all trust

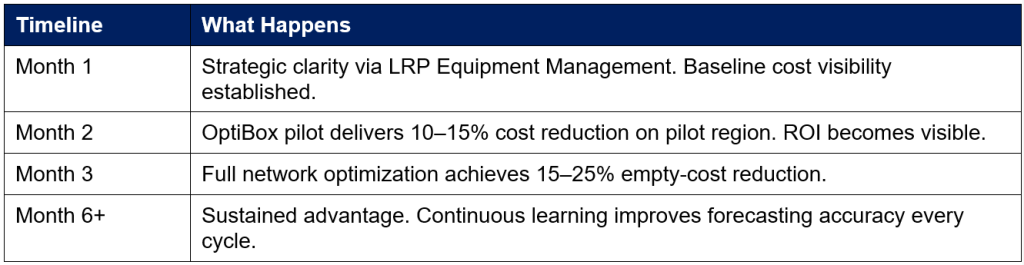

Getting Started: A Realistic Path for Regional Carriers

The most common concern from mid-scale carriers is not whether optimization works — it is whether the implementation path is realistic for their organization. The answer is yes. Solverminds recommends a phased approach designed to deliver visible ROI quickly and scale without disruption.

Phase 1: Strategic Foundation (Month 1)

Implement LRP Equipment Management. Establish demand forecasting, model current fleet sizing and positioning, create a strategic equipment plan, and build organizational understanding of where costs are going.

Phase 2: Tactical Optimization (Month 2)

Deploy OptiBox – starting with a pilot region or trade lane. Validate optimization recommendations against current manual plans. Measure cost reduction and service improvement. Build confidence in AI-driven decisions before scaling.

Phase 3: Integration and Scale (Month 3)

Connect OptiBox and LRP for closed-loop planning. Expand to full network coverage. Automate routine repositioning decisions. Establish a continuous improvement process that learns and tightens with every cycle.

Typical ROI Timeline

Investment reality for mid-scale carriers: Implementation is measured in weeks, not years. Pricing scales to your fleet size. OptiBox works with your existing systems, no ground-up IT project required. The first quantifiable margin improvement typically appears within the pilot phase.

Conclusion: From Cost Burden to Competitive Capability

Empty container management has fundamentally changed. Manual, reactive approaches that were acceptable a decade ago now represent measurable competitive disadvantage particularly for regional carriers where every percentage point of cost matters.

The carriers that will win in the next decade will not necessarily be the largest. They will be the most operationally consistent, the most responsive to demand shifts, and the most efficient with their assets.

LRP Equipment Management provides the strategic foundation. OptiBox delivers the AI-driven optimization. Together, they transform empty container logistics from a cost problem into a competitive capability.

The question is not whether to act. The question is: how quickly can you turn your biggest margin leak into an advantage?

About Solverminds

Solverminds Solutions & Technologies has partnered with global and regional shipping organizations since 2003 to transform planning, execution, and optimization. Our platforms including OptiBox, LRP, SEDGE IQ, OptiFleet, and ASTRA enable carriers of all sizes to operate complex networks with clarity, efficiency, and confidence.

Decisions, not data, create value.

Take the Next Step

If empty container costs are impacting your margins and service levels, we invite you to explore how OptiBox and LRP can help with no commitment and no pressure.

Contact us to:

- Assess your current empty repositioning costs and where the biggest savings lie

- See a live demonstration of OptiBox and LRP Equipment Management

- Discuss a phased implementation tailored to your network and budget

- Review how other regional carriers achieved 15–25% cost reduction

www.solverminds.com | enquiry@solverminds.com

Let’s turn your empty container challenge into competitive advantage.

Since 2003, Solverminds has partnered with liner shipping companies, agencies, NVOCCs, and feeder operators to transform how the industry plans, executes, and optimizes operations. Our integrated platform spans executive intelligence (SEDGIQ), network and fleet optimization (OptiFleet), container flow optimization (OptiBox), and operational execution (ASTRA).

Headquartered in Chennai with over 800 team members, we serve clients across Asia, the Middle East, Europe, and the Americas. Our premise is simple: decisions, not data, create value.

Contact: enquiry@solverminds.com

Web: www.solverminds.com

The information or views expressed in this article is authentic to the best of our knowledge, and as such, it is prone to errors and the absence of some key information, for more information please review our Terms of Use

Solverminds is a global leader in AI-driven maritime software solutions, trusted by top shipping lines, NVOCCs, and feeder operators worldwide. Our mission is to help maritime businesses optimize operations, ensure compliance, and boost profitability through intelligent digital transformation

We offer ERP solutions, optimizers, ASTRA for intelligent process automation, and consultations for your company’s unique needs.

Contact us with a strong focus on digital transformation and sustainable shipping, we help maritime businesses meet IMO compliance, reduce costs, and optimize every aspect of their supply chain.